-

The Hybrid Future of Collections AI

If you’ve ever worried an AI bot was coming for your job, relax. It’s more likely coming for that tedious RPC verification you hate doing anyway. In collections, it’s easy to hear “AI” and picture a robotic takeover. The headlines don’t help, plenty of breathless coverage makes it sound like machines will be running entire

-

5 Subtle Signs Your Top Agent Is Quiet Quitting

Your best collector isn’t hitting goal. Again. You chalk it up to a rough month, a tough portfolio, or new agents pulling more attention. But then another month passes, and the numbers still aren’t there. What gives? Burnout and quiet quitting don’t always show up with a dramatic resignation letter or a direct complaint. Sometimes

-

Operations Leader’s Playbook for Remote Contact Center Teams

Remote work isn’t new. In a post-2020 world, contact centers have gone through massive change, and not all of it’s been smooth. Attrition is up. Engagement is down. And “just walking the floor” is no longer a management strategy. The shift to remote and hybrid teams forced operations leaders to rethink visibility, coaching, and culture.

-

Virtual Agents in Debt Collection

The rise of AI in debt collection is no longer theoretical. Virtual agents, AI-powered systems handling conversations via voice, text, email, and chat, are already shaping how organizations communicate at scale. But innovation in a regulated industry comes with high stakes. Choosing the wrong tool can mean compliance headaches, reputational damage, and wasted spend. The

-

The Innovation Roadmap: Balancing Risk, Culture, and Change

Overview: If you’ve ever tried launching a new initiative inside a highly regulated organization, you know the feeling: a cocktail of ambition, red tape, and the soul-crushing phrase, “we’ve always done it this way.” But innovation isn’t optional anymore. The speed of technological change means you either evolve or risk falling behind. This post offers

-

Your Agents Don’t Hate Speech Analytics

Your agents don’t hate speech analytics… They hate how leadership is using it. If your GPS interrupted you every 10 seconds while driving, “Turn left. Not now. In 2 miles. Never mind, rerouting.”… you’d rip it off your dashboard by day two. That’s what speech analytics feels like to your agents when it’s overused, misused,

-

The End of Anecdotal QA

Remember when QA meant reviewing five random calls a month and hoping for the best? Those days are over. Or at least, they should be. In 2025, the most forward-thinking teams aren’t relying on anecdotes, gut checks, or the infamous “one person with a clipboard” coaching model. They’re using real-time and post-call AI analytics to

-

10 Questions to Uncover What’s Really Holding an Agent Back

If your one-on-ones sound more like polite small talk than actual coaching… you’re not alone. Supervisor: “How’s everything going?” Agent: “Good.” Supervisor: “Okay, keep it up!” And just like that, another coaching opportunity disappears into the ether. The truth is, most underperformance isn’t due to laziness or lack of willpower. It’s often stress, confusion, burnout,

-

RPA: Practical Automation Wins for Compliance-Heavy Industries

Let’s be honest, “Robotic Process Automation” sounds more intimidating than it actually is. Despite the high-tech name, it’s less about robotics and more about freeing up your team’s time by eliminating tedious tasks. RPA is more like a reliable assembly line worker who does the same task, the same way, every time, no caffeine required.

-

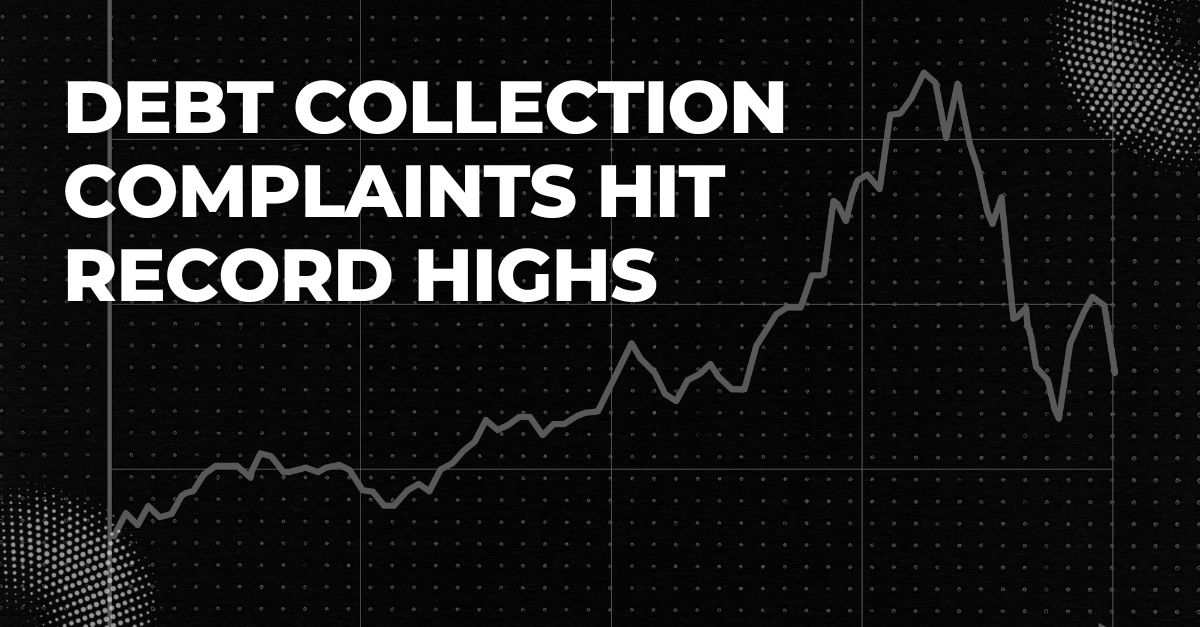

Debt Collection Complaints Hit Record Highs

TL;DR Debt collection complaints more than doubled between 2023 and 2024, and Q1 2025 alone has already surpassed all of 2023. Harassment makes up nearly half of all reports, with states like Georgia, Texas, and Florida seeing the most per capita complaints. If you’re a compliance or operations lead, now’s the time to audit, retrain,

-

Your Guide to Confident Tech Adoption

Use this checklist to assess your organization’s preparedness for adopting new technology and to guide a successful implementation process. Define Objectives Stakeholder Engagement & Requirements Plan for Risk and Compliance Requirements Download the checklist to see sections 2-6.

-

Agent Onboarding Checklist for Compliance-Driven Industries

Agent onboarding isn’t just a box to check, it’s a make-or-break process that affects performance, compliance, and retention. In highly regulated industries like healthcare, financial services, and debt collection, onboarding new agents is more than basic training. It ensures agents understand industry regulations, handle sensitive data properly, and communicate clearly with customers. A weak onboarding